Resources

Ongoing Corporate Compliance Requirements in Singapore

When a company is incorporated in Singapore, it is legally required to adhere to the statutory mandates set out in the Singapore Companies Act. Compliance involves regular submission of filing requirements to the Accounting and Corporate Regulatory Authority (ACRA) and the Inland Revenue Authority of Singapore (IRAS) to avoid penalties and legal repercussions.

I. Governance and Officer Requirements

The company must maintain specific corporate officer roles and governance standards:

Resident Director: A minimum of one director must be ordinarily resident in Singapore (Citizen, Permanent Resident, or Employment Pass/EntrePass holder under the Company).

Directors must be at least 18 years old and not bankrupt or convicted of certain crimes.

There is no limit on the number of additional local or foreign directors.

Company Secretary: Must be a natural person who is ordinarily resident in Singapore.

Must be appointed within six months of the company’s incorporation.

Registered Office: All companies must have a physical registered office address in Singapore.

The office must be open to the public for a minimum of three hours per day during normal business hours on weekdays.

Company Registration Number (UEN): The Unique Entity Number (UEN) must be clearly displayed on all official business documents, including business letters, statements of account, invoices, and publications.

Notification of Changes: The company must update ACRA within the stipulated time of any changes to the company’s particulars (e.g., shareholders, capital, and officers).

II. Financial Reporting and Audit Requirements

A core component of compliance is defining and maintaining the financial reporting cycle:

Financial Year End (FYE): The company is free to determine its own FYE. However, strict rules govern changes to this date:

Companies must notify the Registrar (ACRA) of their FYE upon incorporation and of any subsequent changes.

The duration of a company’s financial year must generally not exceed 18 months in the year of incorporation (unless approved by the Registrar).

Approval from ACRA is required if the change in FYE results in a financial year longer than 18 months or if the FYE was changed within the last 5 years.

Appointment of Auditors: All Singapore companies must appoint an auditor within three months of incorporation, unless they are exempted.

Small Company Audit Exemption (for FYs starting on or after 1 July 2015): A private company is exempt if it qualifies as a “small company” for the immediate past two consecutive financial years.

A company is “small” if it meets at least 2 of 3 criteria for the past two consecutive financial years: total annual revenue ≤ S$10m, total assets ≤ S$10m, and number of employees ≤ 50.

If part of a group, the entire group must also qualify as a “small group.”

III. Tax and Other Statutory Contributions

Compliance extends to tax obligations and mandatory employee contributions:

Start-Up Tax Exemption (SUTE) Consideration: The first financial year should ideally be kept under 12 months to ensure the company fully benefits from the SUTE scheme for its first three consecutive Years of Assessment (YA). A financial period longer than 12 months is treated as two YAs by IRAS, reducing the benefit period.

Goods and Services Tax (GST) Registration:

Mandatory: Registration is required if the annual taxable revenue is more than S$1 million (retrospective or prospective view). The business must register within 30 days of becoming liable.

Voluntary: Businesses may choose to register voluntarily, subject to IRAS approval and a commitment to remain registered for a minimum of two years.

Customs Registration (CR Number): Required if business activities involve import, export, or trans-shipment into and out of Singapore.

Central Provident Fund (CPF) and Skill Development Fund (SDF):

CPF: Mandatory pension fund contributions are required for all local employees (Citizens/PRs) earning over S$50 per month.

SDF: Employers must contribute a fee to the SDF for all employees up to the first S$4,500 of gross monthly remuneration (currently 0.25% or S$2, whichever is higher).

The company is also the collecting agent for mandatory contributions to Self-Help Group (SHG) Funds (CDAC, ECF, MBMF, SINDA) from local employees.

Business Licences and Permits: Relevant government approvals and/or licences must be obtained for specific business activities before operations can commence.

IRAS Compliance Requirements for Singapore Companies

As a company registered in Singapore, compliance with the Inland Revenue Authority of Singapore (IRAS) involves two primary annual filing requirements: the Estimated Chargeable Income (ECI) submission and the Corporate Income Tax Return (Form C/C-S) submission.

I. Estimated Chargeable Income (ECI)

The ECI is an estimation of a company’s chargeable income (profits) for a specific Year of Assessment (YA).

Filing Requirement: ECI must be submitted to IRAS within three months after the company’s financial year ends (FYE).

“Nil” ECI Filing: Even if a company estimates its chargeable income as zero, it must still file a “Nil” ECI return, unless exempted.

Disclosure of Revenue: Companies are required to declare their annual revenue amount in the ECI Form to provide key economic data for policy-making.

| Exemption from Filing ECI | Financial Year End (FYE) in or after Jul 2017 |

| Annual Revenue | Not more than S$5 million |

| Estimated Chargeable Income (ECI) | NIL |

Advantage of Early Filing: IRAS provides flexible installment plans for tax payments based on the date the ECI is filed:

Filing by the 26th day of the 1st month after FYE: 10 installments.

Filing by the 26th day of the 2nd month after FYE: 8 installments.

Filing by the 26th day of the 3rd month after FYE: 6 installments.

Failure to File: If a company fails to file the ECI within the three-month deadline, IRAS will issue a Notice of Assessment (NOA) based on its own estimation of the company’s income. The company has one month to submit a written objection; otherwise, the NOA is deemed final.

II. Corporate Income Tax Return (Form C/C-S)

This is the official annual tax return submitted to IRAS, reporting the company’s actual chargeable income.

Filing Deadline: The deadline for filing the Corporate Income Tax Return is 30 November (for paper-filing) of the YA following the financial year end.

Documents Required: The submission typically includes the Audited or Unaudited Report and the Tax Computation (Form C).

Simplified Filing (Form C-S)

To simplify compliance for small companies, Form C-S is a shortened, three-page return.

A company qualifies to file Form C-S (from YA 2017) if it meets all the following conditions:

The company is incorporated in Singapore.

Annual revenue is S$5 million or below.

The company derives income taxable only at the prevailing corporate tax rate of 17%.

The company is not claiming any of the following:

Carry-back of Current Year Capital Allowances/Losses.

Group Relief.

Investment Allowance.

Foreign Tax Credit and Tax Deducted at Source.

III. Accounting and Audit Requirements

Proper maintenance of accounts is mandatory and underpins the tax filing process.

Accounting Records: All Singapore companies must prepare accounts and reports (P&L, Balance Sheet, Cash Flow Statement, Equity Statement) in accordance with the Singapore Financial Reporting Standards (SFRS).

Accounting records must be kept for a minimum of five years.

Submission of Financial Reports: Every company must submit a Financial Report, which includes financial statements, notes, disclosure of accounting policies, and details of operations and director/shareholder interests.

Audit Exemption (Unaudited Report): A company is generally exempt from preparing an Audited Report if it qualifies as a “small company” for the immediate past two consecutive financial years (applies to FYs beginning on or after 1 July 2015).

Conditions for “Small Company” Qualification:

A company is a “small company” if:

It is a private company.

It meets at least 2 out of 3 of the following quantitative criteria for the immediate past two consecutive financial years:

Total Annual Revenue is not more than S$10 million.

Total Assets is not more than S$10 million.

Number of Employees is not more than 50.

If the company is part of a group, the entire group must also qualify as a “small group” on a consolidated basis for the audit exemption to apply.

IRAS Guide: Applying for GST Registration

Goods and Services Tax (GST) registration in Singapore can be mandatory or voluntary, but in both cases, it comes with a set of statutory responsibilities. The registration process is primarily conducted online via the IRAS myTax Portal.

I. Determining the Need to Register (Compulsory Registration)

A business must register for GST if its taxable turnover exceeds or is expected to exceed the legislated threshold of S$1 million. This is determined using two main views:

Retrospective View:

The business’s total taxable turnover exceeded S$1 million at the end of any calendar year (e.g., 1 Jan to 31 Dec).

Deadline: The business must apply for GST registration within 30 days from the end of that calendar year.

Prospective View:

The business has reasonable grounds to expect that its total taxable turnover will exceed S$1 million in the next 12 months (e.g., due to a new contract or significant business expansion).

Deadline: The business must apply within 30 days from the date of the forecast.

Exceptions to Compulsory Registration:

A business may apply for exemption if its taxable supplies are wholly or mainly zero-rated (e.g., 90% or more are exports).

A business is not required to register if, despite meeting the retrospective threshold, it can provide supporting documentation to confirm with certainty that its turnover for the next 12 months will not exceed S$1 million (e.g., due to downsizing).

II. Voluntary GST Registration

Businesses that do not meet the S$1 million turnover threshold may choose to register for GST voluntarily. The main benefit is the ability to claim input tax (GST paid on business purchases and expenses), which can be advantageous for businesses with high expenses or those making zero-rated (export) sales.

Key Requirements and Commitments for Voluntary Registration:

e-Learning Course: The company director, sole-proprietor, partner, trustee, and/or GST return preparer must complete the IRAS “Overview of GST” e-Learning course and pass the quiz (exceptions apply for experienced tax professionals or existing GST managers).

GIRO Setup: The business must apply for a GIRO arrangement for GST payments and refunds.

Minimum Commitment: Once approved, the business must remain GST-registered for a minimum of two years and comply with all GST obligations.

InvoiceNow Requirement: New voluntary GST registrants may be required to adopt the InvoiceNow e-invoicing platform (mandatory implementation is being phased in, starting with newly incorporated voluntary registrants).

III. The Application and Processing Steps

The GST registration process is standardized, regardless of whether the registration is compulsory or voluntary.

Determine Registration Type: Assess if registration is mandatory or if a voluntary application is preferred.

Complete e-Learning (for Voluntary applicants): Complete the prerequisite course.

Submit Application: All applications and supporting documents must be submitted online via the myTax Portal (mytax.iras.gov.sg).

The user must first be authorized in Corppass for the “GST (Filing and Application)” digital service.

Required documents (e.g., business profiles, financial statements, and details of business activities) must be prepared and attached.

Processing and Approval:

IRAS typically processes applications within 10 working days, but complex cases may take up to 30 days or longer if additional documents are required.

Upon approval, IRAS will issue a confirmation letter containing the GST Registration Number and the Effective Date of Registration.

Critical Compliance Points:

A business must not charge GST to customers before the stated effective date of registration.

If a business fails to register on time for compulsory registration, the effective date may be backdated, and the business will be required to pay the GST on all taxable sales made from that date, even if the tax was not collected from customers.

Once registered, the business must charge GST, file accurate quarterly GST returns, pay tax due on time, and keep proper business and accounting records for at least five years.

IRAS e-Tax Guide: Incorporation of Companies by Medical Professionals and Relevant Tax Implications

This e-Tax Guide from the Inland Revenue Authority of Singapore (IRAS), published on September 9, 2024 , addresses the use of corporate structures by medical professionals in private practice, whose income is often derived largely from personal services. IRAS has observed arrangements where professionals incorporate one or more companies with few or no bona fide commercial reasons. The primary motivation for such arrangements is to obtain tax advantages that are not intended by Parliament.

The tax advantages frequently sought through corporatization include an overall lower effective tax rate, as the corporate income tax rate (17% since YA 2010) is lower than the highest marginal personal income tax rate (up to 24% from YA 2024). Additionally, companies may unduly benefit from corporate tax exemptions and rebates, such as the Start-up Tax Exemption Scheme (SUTE). While taxpayers have the prerogative to structure their businesses, obtaining a tax advantage cannot be one of the main purposes of the chosen arrangement. Where tax avoidance is found, IRAS will apply Section 33 of the Income Tax Act (ITA) to negate the undue tax advantage.

IRAS’s Three-Step Anti-Avoidance Framework

IRAS adopts a three-step approach, based on the principles enunciated by the Court of Appeal, to determine if tax avoidance has taken place:

Step 1: Tax Advantage: Consider whether the arrangement results in a tax advantage, such as altering or reducing a tax liability that would otherwise have been payable.

Step 2: Statutory Exception (Section 33(7)): Determine if the arrangement was carried out for “bona fide commercial reasons” and if the avoidance or reduction of tax was not one of the “main purposes”.

IRAS will evaluate the company’s functions, assets, risks, and whether the medical professional’s remuneration is at arm’s length.

Note: Incorporating a company solely to isolate litigation risks of a medical nature is not considered a valid bona fide commercial reason, as medical professionals remain personally accountable for their services.

Step 3: Parliament’s Contemplation: If Step 2 fails, ascertain if the tax advantage obtained was within Parliament’s intended scope and purpose for the specific tax provision, both in legal form and economic reality.

Key Tax Avoidance Arrangements Targeted by IRAS

The Comptroller of Income Tax (CIT) regards the following four broad groups of arrangements as having the effect of tax avoidance within the meaning of Section 33(1) of the ITA:

Shifting of income derived mainly from one’s personal efforts or skills to a company. This often involves the doctor paying themselves a nominal salary while keeping the bulk of the profits in the company to enjoy lower corporate tax rates.

Artificial splitting of income through the incorporation of multiple companies. This is done when income from one set of operations (e.g., consultation, surgery, medicine sales) is divided across several companies to multiply tax exemptions.

Artificial re-incorporation of the same business. This involves winding up or striking off an existing company and starting a new one every three years to continuously exploit the Start-up Tax Exemption Scheme (SUTE).

Attribution of income or profit not aligned with economic reality. This occurs when the remuneration paid to the medical professional is not aligned with the market value of similar services, resulting in over-attribution of income to the company.

Arm’s Length Remuneration (ALR)

To avoid an arrangement being deemed tax avoidance, any income earned from the medical practice must be attributed between the doctor and the company according to their respective contributions. This is determined by ensuring the doctor receives an Arm’s Length Remuneration (ALR).

IRAS provides two methods for determining ALR:

Market Salary Benchmarking: Remunerating the doctor based on factors like area of expertise, years of experience, and roles performed (practitioner, director, etc.).

Cost Plus Method: This is an alternative derived from transfer pricing methodology. It is applied to the company’s cost base for providing support services, with a percentage mark-up to determine the company’s profit share; the remaining profits are attributed to the doctor. The recommended mark-ups on the company’s cost base are:

10% for Specialist services.

15% for Dental/General Practitioner (GP) services.

Consequences of Tax Avoidance

If the CIT determines that tax avoidance has occurred, Section 33 will be invoked to vary the arrangement. This may result in the following outcomes:

The company structure may be disregarded, and all income initially attributed to the company will be assessed and taxed in the individual’s capacity.

Income split across multiple companies for the same operation will be consolidated and taxed under a single entity.

If key personnel are under-remunerated, IRAS will apply the Cost-Plus Method or Market Salary Benchmarking to determine the arm’s length amount due to the individual.

A Section 33A surcharge will be imposed on the tax or additional tax arising from the adjustments, with effect from Year of Assessment (YA) 2023.

Launching of the Variable Capital Companies Framework by MAS and ACRA

On the 15th January 2020, the Monetary Authority of Singapore (MAS) together with the Accounting and Corporate Regulatory Authority (ACRA) launched the Variable Capital Companies (VCC) framework. The VCC is intended to be a new corporate structure that can cater to a wide range of investment funds. It is meant to provide fund managers with better operational flexibility and cost savings. The savings is possible with the centralisation of fund management activities and the flexibility to structure funds more efficiently.

2020年1月15日,新加坡金融管理局(MAS)与会计与企业管理局(ACRA)共同启动了可变动资本公司(VCC)框架。 VCC旨在成为一种新的公司结构,可以满足各种投资基金的要求。它旨在为基金经理提供更好的运营灵活性和成本节省。通过集中的基金管理以及灵活组织基金架构,可以达到节省开支的目的。

To encourage industry adoption of the VCC framework, MAS has introduced a Variable Capital Companies Grant Scheme. The grant scheme will help defray costs involved in incorporating or registering a VCC by co-funding up to 70% of eligible expenses paid to Singapore-based service providers. The grant is capped at S$150,000 for each application, with a maximum of three VCCs per fund manager. The grant scheme will be funded by the Financial Sector Development Fund (FSDF) and will take immediate effect and applicable for a period of up to three years. Applicants for the VCC Grant Scheme should be Qualifying Fund Managers (*) that have incorporated a VCC or have successfully re-domiciled a foreign corporate entity to Singapore as a VCC, and have obtained a notice of incorporation or transfer of registration from ACRA. Additionally, fund managers will have to submit an application to MAS, should they wish to apply for the 13R or 13X tax exemption schemes. This is done post-incorporation of the VCC.

为了鼓励业界采用VCC框架,MAS推出了可变动资本公司补助计划。该补助计划将补贴最高70%的注册VCC时产生的费用。每项申请的补助金上限为15万新币,每位基金经理最多可在三个VCC享受这项补助。该补助计划将由金融部门发展基金(FSDF)资助,并立即生效,有效期达三年。VCC补助计划的申请者应为合格的基金经理*,他们已经注册了VCC或已成功将外国公司实体重新注册为VCC到新加坡,并已从ACRA获得注册成立或转让的通知。此外,如果基金经理希望申请13R或13X免税计划,必须向MAS提交申请。申请13R或13X免税计划可在注册VCC后操作。

Last September 2019, MAS and ACRA initiated a VCC Pilot Programme that was well participated by a group of fund managers. This group of managers currently have incorporated or re-domiciled a total of 20 investment funds as VCCs. These investment funds comprise venture capital, private equity, hedge fund and Environmental, Social, and Governance (ESG) strategies. This substantiates that the VCC framework is able to support a diverse range of investment funds.

2019年9月,MAS和ACRA发起了VCC试点计划,该计划得到了一组基金经理的积极参与。这组基金经理目前已注册或重组了20个投资基金作为VCC。这些投资基金包括风险投资、私募股权、对冲基金以及环境、社会和治理(ESG)策略基金。这证实了VCC框架能够支持各种投资基金。

The VCC framework should also create new opportunities for Singapore-based fund service providers such as legal and tax advisors, accountants, fund administrators and fund custodians. Overall, this advances Singapore another step towards being a full-service international fund management centre.

VCC框架还应该可为新加坡的基金服务提供商(例如法律和税务顾问、会计师,、基金管理人和基金托管人)创造新的机会。总体而言,这是新加坡迈向提供全方位服务的国际基金管理中心的又一步。

Note (*) : A Qualifying Fund Manager is defined as:

(i) a licensed fund management company, i.e., a holder of a capital markets services license for fund management under section 86 of the Securities and Futures Act (Cap. 289);

(ii) a registered fund management company, i.e. a corporation which is exempted from holding a capital markets services licence under paragraph 5(1)(i) of the Second Schedule to the Securities and Futures (Licensing and Conduct of Business) Regulations; or

(iii) a financial institution exempted under sections 99(1)(a), (b), (c) or (d) of the SFA from the requirement to hold a capital markets services licence to carry on business in fund management i.e., a bank licensed under the Banking Act (Cap. 19), a merchant bank approved under the MAS Act (Cap. 186), a finance company licensed under the Finance Companies Act (Cap. 108) or a company or co-operative society licensed under the Insurance Act (Cap. 142).

注*:合格的基金经理的定义为:

(i)持牌基金管理公司,即《证券和期货法》第289章第86条规定的资本市场服务基金管理许可持有人;

(ii)注册基金管理公司,即根据《证券和期货(许可和经营行为)条例》附表2第5(1)(i)条获豁免持有资本市场服务许可证的公司;或

(iii)根据SFA第99(1)(a), (b), (c)或(d)条获豁免的金融机构,其无需持有资本市场服务许可证即可从事基金管理业务,即根据《银行法》第19章获得许可的银行,根据《金融服务法案》第186章获得批准的商业银行,根据《金融公司法》第108章获得许可的金融公司或经《保险法》第142章许可的公司

The Variable Capital Company

Published: 11th November 2020

BACKGROUND

The recent introduction of the Singapore Variable Capital Company (“VCC”) structure into the fund management industry is a move by the government to bring Singapore on par with other established global fund centres like Luxembourg, Ireland, Cayman Islands and Mauritius. This development brings a new beginning of options for fund and wealth managers and creates new business opportunities for Singaporean accountants, custodians, lawyers and tax advisors.

The Variable Capital Company (“VCC”) is an alternative to the existing Singapore fund structure. Existing available structures are company, limited partnerships, and unit trust structures. The VCC Act was passed in October 2018 and a draft regulation was released in Q2 2019 for public consultation and feedback. The implementation timeline is likely to be end 2019.

KEY FEATURES

- The VCC will be regulated by the Variable Capital Companies Act (“VCC Act”). The Accounting and Corporate Regulatory Authority (“ACRA”) will be the administrator of the VCC Act. The Monetary Authority of Singapore (MAS) will provide overview of the Anti-Money Laundering and Countering Financing of Terrorism (“AML/CFT”) obligations. The Securities and Futures Act will govern the share issue and other general activities of the VCC.

- The VCC can be set up as a Collective Investment Scheme in two ways :

(a) a stand-alone entity

(b) as an umbrella entity with multiple sub-funds (each with its own segregated assets and liabilities).

- The VCC can be used for traditional and alternative fund strategies (both open-ended and close-ended)

- The Annual General Meeting (“AGM”) can be waived at the discretion of the Board of Directors, subject to meeting certain conditions under the VCC Act

- The register of members of a VCC is not required to be open for inspection by the public, thus preserving privacy. However the register must be open for inspection by the following or upon a order of court:

(a) Manager of the VCC;

(b) Custodian of the VCC (being a non-umbrella VCC)

(c) Public authorities (Government, ACRA and the MAS)

ADVANTAGES

- Free movement of capital as shareholders have more flexibility to enter and exit a fund through easy subscription and redemption of shares. A VCC can redeem shares and pay dividends using its net assets or capital. (This gives flexibility in distribution and return of capital).

- The VCCs can operate as umbrella funds with several sub-funds (with different investment objectives, investors, and asset classes). There is economies of scale as the sub-funds can share the same board of directors, fund manager, administrator, custodian and auditor

- Tax exemption under Section 13R (Fund Tax Exemption Scheme) and Section 13X (Enhanced Tier Fund Tax Exemption Scheme) of the Singapore Income Tax Act.

REQUIREMENTS

- Appoint a fund management company (“FMC”) that is licensed by MAS, or is an exempt financial institution in Singapore

- A Singapore registered office, Singapore resident company secretary and auditor, and at least one resident director

- At least one director must be a director or registered representative of the FMC. All directors must be fit and proper persons

- Comply with AML/CFT requirements. These can be outsourced to the FMC of the VCC or a regulated financial institution in Singapore

5. For its accounting, adopt US GAAP, Singapore Accounting Standards Council or IFRS. For VCC offered to retail investors, RAP7 (Reporting For Unit Trusts, ISCA) must be adopted.

For further information on how to set up a VCC in Singapore, please contact us.

This article is for communication purposes only. Any act or omission made solely in whole or in part of this article is determined and therefore the consequences are the responsibility of the perpetrator. If you need to reprint or quote any of the content in this article, please indicate the source.

Family Office and Funds in Singapore

Published: 11th November 2020

Singapore has been considered as a one of the key locations for hedge funds, real estate funds and private equity. It has been positioned to be in the same league as the Cayman Islands, Bahamas and British Virgin Islands.

The growth of the fund industry in Singapore has been encouraged by tax incentives for funds and the business friendly environment. The Singapore Budget Statement for the financial year 2019 was delivered by Minister for Finance, Mr. Heng in Parliament on 18th February 2019. The latest Budget extended the existing Tax Incentive Schemes which were due to expire on 31 March 2019, further until 31 December 2024. The Tax Incentive Schemes were also fine-tuned for relevance and to facilitate compliance.

Funds managed by a Singapore based fund manager are liable to tax in Singapore except where they qualify for various tax incentive schemes with specific conditions met. These tax incentive schemes allow for ‘‘specified income” derived by the qualifying fund from ‘‘designated investments’’ to be exempted from tax. These designated investments encompass a range of investments (shares, securities and derivatives) but exclude immovable property in Singapore. In order to qualify for tax incentive, the requirements for the fund manager are as follows :

- register with the Monetary Authority of Singapore (‘‘MAS’’) or

- hold a capital markets services (‘‘CMS’’) licence

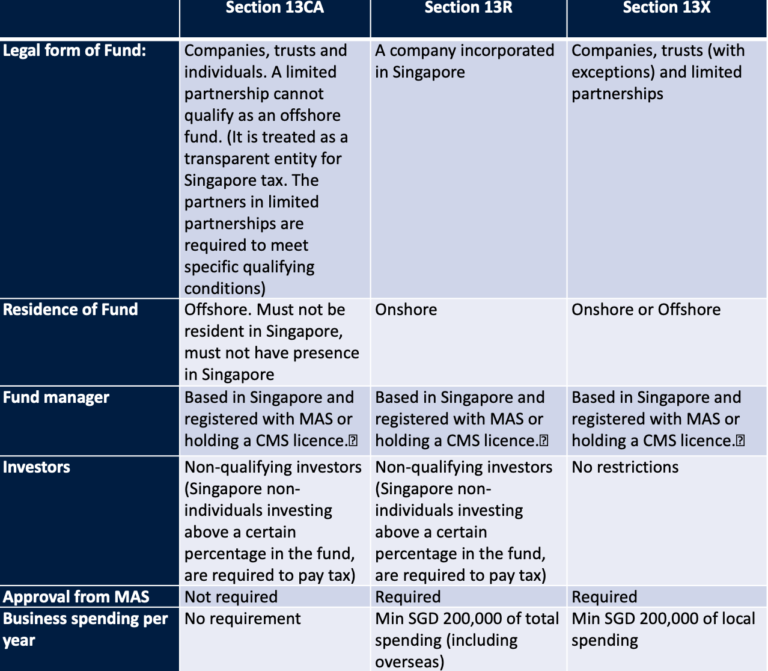

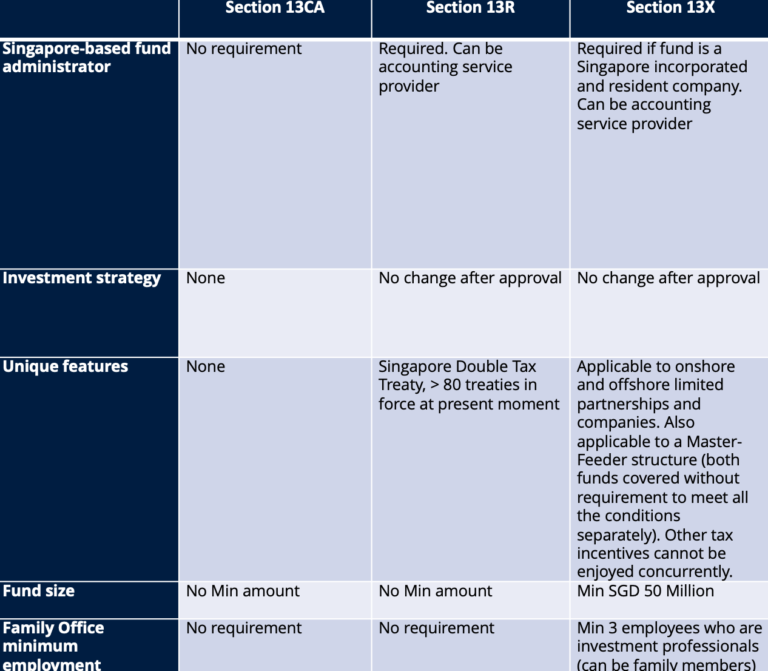

The three main tax exemption schemes for funds currently available in Singapore are:

- Section 13CA : Offshore Fund Tax Exemption Scheme

- Section 13R : Onshore Fund Tax Exemption Scheme

- Section 13X : Enhanced Tier Fund Tax Exemption Scheme

For more information, please reach out to us via email at admin@varicorp.com.sg